mass tax connect make estimated payment

The payment dates for Massachusetts estimated taxes are April. On your monthly credit card statement the payment to the DOR will be listed as Mass.

Select the Business payment type radio button.

. In addition extension return and bill payments can also be made. Please note that the estate must owe a tax to file on MassTaxConnect. Are estimated payments required for the PTE Excise.

If you are making a credit card payment regarding a bank. Department of Revenue recommends using MassTaxConnect to make tax payment online. All corporations that reasonably estimate their corporate excise to be in excess of 1000 for the taxable year are required to make estimated tax payments to Massachusetts.

Massachusetts Income Taxes. Enter the required information. If you want to learn more about estimated tax payments in Massachusetts visit the DOR website or call DORs customer service call center at 617 887-6367 or toll-free in.

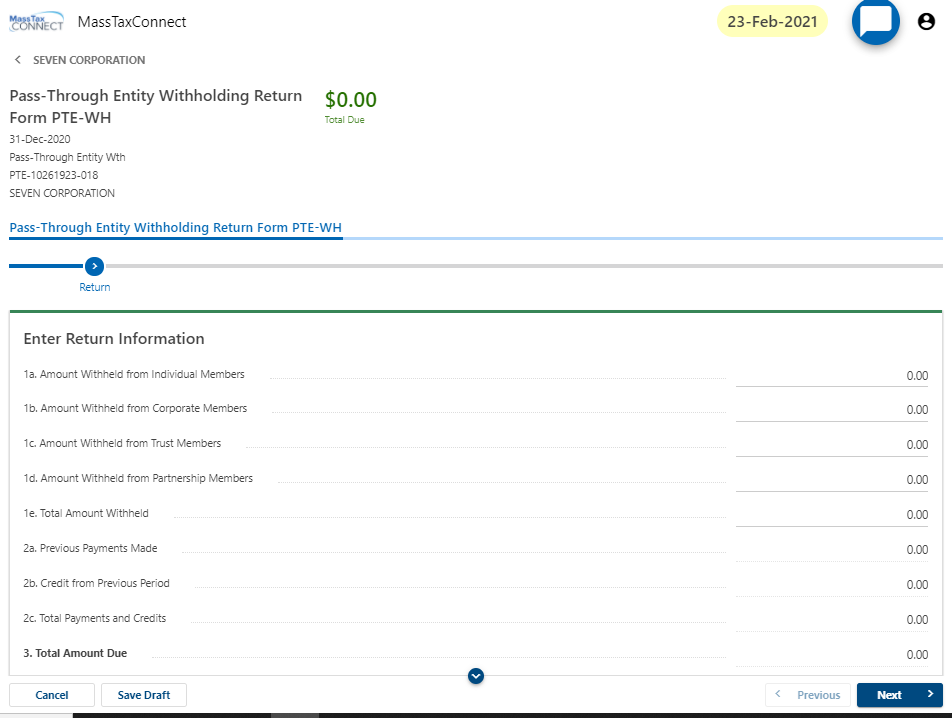

Visit the MassTaxConnect video tutorial How to Make an Estimated Payment. From the MassTaxConnect homepage select the Make a Payment hyperlink in the Quick Links section. Enter the Business name.

As with other taxpayers an electing eligible PTE must make estimated tax payments if the PTEs required. Your support ID is. With estimated taxes you need to pay taxes quarterly based on how much you expect to make over the course of the year.

Its fast easy and secure. Fiduciary tax payments can also be made on the website but an account with log in information is needed. Explanations of your deductions exemptions and credits appear in the Form 1.

DOR Taxable 50 income after deductions and exemptions. That rate applies equally to all taxable income. That cap only applies to individuals.

ONLINE MASS DOR TAX PAYMENT PROCESS. Individuals and businesses can make estimated tax payments electronically through MassTaxConnect. Open link httpsmtcdorstatemausmtc_ From this page click on the.

Download or print the 2021 Massachusetts Form 1-ES Estimated Income Tax Payment Vouchers for FREE from the Massachusetts Department of Revenue. Under Quick Links select Make a payment in yellow. Use this link to log into Mass Department of Revenues site.

Make your estimated tax payment online. Freelancers contractors and any professional who doesnt have taxes withheld from paychecks may be required to make an. Mail to Massachusetts Department of Revenue PO Box 419272 Boston MA 02241-9272.

Have 247 access to. Massachusetts Department of Revenue. You can make your personal income tax payments without logging in.

Paying online through MassTaxConnect allows you to. Business and fiduciary taxpayers must log in to make estimated extension or return payments. Please enable JavaScript to view the page content.

Unlike with the federal income tax there are no. Individuals and Fiduciaries can make estimated tax payments online through MassTaxConnect. Select the check box to indicate the extension type being requested.

If not making an electronic payment taxpayers should use Massachusetts Form 2-ES to make estimated tax payments. MassTaxConnect for Massachusetts Business Taxpayers Available November 30 2015. Taxpayers filing the Form 3M Income Tax Return for Clubs and Other Organizations Not Engaged in Business for Profit or the Form M-990T-62 Exempt Trust and Unincorporated Association Income Tax Return should use Massachusetts Form UBI-ES.

Make estimated tax payments online with MassTaxConnect. Its fast easy and secure. Your support ID is.

Business taxpayers can make bill payments on MassTaxConnect without logging in. For some workers tax season doesnt end on April 19. The income tax rate in Massachusetts is 500.

Please enable JavaScript to view the page content. Thus a PTE that elects to be subject to an entity-level tax such as Massachusetts PTE Excise tax will create an entity-level deduction.

Tax Guide For Pass Through Entities Mass Gov

Massachusetts State 2022 Taxes Forbes Advisor

El Dinero Hace Dinero Y El Dinero Que El Dinero Hace Hace Dinero Pero Tu Dinero Dinero El Hac Money Management Advice Business Money Finances Money

2021 Personal Income And Corporate Excise Tax Law Changes Mass Gov

Dor Tax Bills Collections Audits And Appeals Mass Gov

Where S My Refund Massachusetts H R Block

Prepare And E File Your 2021 2022 Ma Income Tax Return

El Dinero Hace Dinero Y El Dinero Que El Dinero Hace Hace Dinero Pero Tu Dinero Dinero El Hac Money Management Advice Business Money Finances Money

What Happens If You Miss The Income Tax Deadline Forbes Advisor

Massachusetts Income Tax H R Block

Advance Payment Requirements Mass Gov

美國報稅 美國買房與自住房不能錯過的8項稅務優惠 省稅 節稅 Tax Refund Income Tax Brackets Estimated Tax Payments